For contemporary parents, safeguarding their child’s individuality is of utmost importance. The best defense against tax-related identity theft is to obtain a unique six-digit number from the IRS.

In this guide, we outline how to get an IP PIN for your child, which securely protects their Social Security number from unauthorized filings.

What Is an IP PIN?

An Identity Protection Personal Identification Number (IP PIN) is a unique six-digit code assigned by the IRS. It serves as a high-level security key for tax returns.

When a taxpayer has an IP PIN, the IRS will automatically reject any electronic or paper return filed without that specific number.

Initially, only verified victims of identity theft received these PINs from the IRS. However, the program is now open to anyone who wants to proactively safeguard their identity.

For a child, this number serves as a “lock” on the child’s Social Security Number (SSN), preventing anyone other than approved guardians from filing a return on their behalf.

How to Get an IP PIN for My Child Online

The official IRS digital gateway is the most effective approach to obtain protection. Keep reading and follow these steps to complete the process smoothly:

1. Create an ID.me Account

The IRS uses a third-party service called “ID.me” to verify identities. As the parent or legal guardian, you must first verify your own identity.

You will need your driver’s license, passport, or state ID, along with a smartphone to take a “selfie” for facial verification.

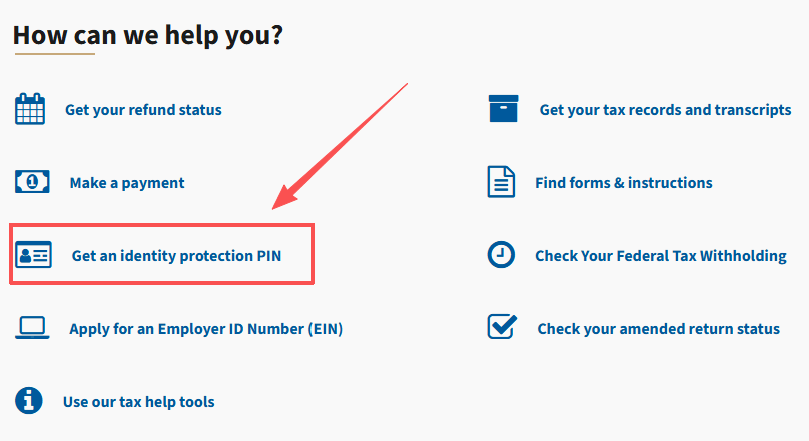

2. Access the “Get An IP PIN” Tool

Once your identity is verified, log in to the IRS official website. Search for the “Get an IP PIN” tool. You will need to navigate through the prompts to indicate you are requesting a PIN for a dependent.

3. Provide Dependent Documentation

You have to demonstrate that the child is your dependent. This usually involves entering their SSN and potentially providing details from a previous tax return where they were claimed.

To make sure there is a match, the IRS cross-references this information with Social Security Administration records.

4. Immediate Generation

In most successful online cases, the system generates the six-digit code immediately on the screen. Important: This online-generated PIN will not be mailed to you by the IRS. You have to print the page or download the confirmation right away.

Tip:

When handling sensitive data like SSNs and IRS login credentials, your digital privacy is at risk from “man-in-the-middle” attacks. We highly recommend using LightningX VPN to secure your connection.

It prevents hackers from intercepting your child’s private information on home or public Wi-Fi by masking your traffic using advanced AES-256 encryption.

It ensures that your route to identity protection is genuinely confidential and is quick and easy to use. Download it for free and enjoy free nodes on your Android/iOS mobile!

What to Do After Receiving Your Child’s IP PIN

Securing the number is only the first step. You must manage it correctly to avoid filing delays.

Store it securely: Treat this six-digit code like a bank password. Do not keep it on an unprotected note on your phone. Use a password manager or a physical safe.

Share with Your Tax Preparer: You have to give the child’s IP PIN to a CPA or other tax expert. The IRS e-file system will reject your family’s complete return without it.

Input in Tax Software: If you file yourself using software like TurboTax or H&R Block, look for the “Identity Protection PIN” section under the “Federal” or “Dependents” tab.

Expect a New One Annually: A key feature of the IP PIN program is that the number expires every year. The IRS will generate a new one each January. To obtain the most recent code, you must return to the portal each year.

Why Is an IP PIN Important for Children?

You might wonder why a minor needs tax protection if they don’t have an income. Unfortunately, children are prime targets for identity thieves. Criminals covet a child’s SSN because it is a “clean slate.”

Since children don’t check their credit reports or file taxes, a thief can use their identity for years without being detected. By the time the child grows up and applies for a student loan or their first job, they may discover their credit is ruined.

Getting an IP PIN creates an instant barrier. The IRS system will immediately stop a fraudster who attempts to use your child’s information to file a false return to claim a Child Tax Credit or other benefits. You can avoid years of court disputes and regulatory problems by taking this proactive move.

What to Do If You Can’t Get an IP PIN for Your Child Online

Not everyone can pass the rigorous ID.me verification process. If the online tool fails, you have two reliable alternatives.

Option 1: File Form 15227

If your household income is below a certain threshold (typically $79,000 for 2026), you can file Form 15227, Application for an Identity Protection Personal Identification Number.

Once the IRS receives this form, they will call you to verify your identity via a series of questions. After verification, they will mail the IP PIN to your address of record.

Option 2: Visit a Taxpayer Assistance Center (TAC)

If you prefer an in-person approach or cannot verify via phone, you can make an appointment at a local IRS office. You must bring:

- Two forms of identification for yourself.

- Your child’s Social Security Card or birth certificate.

- Proof of your relationship to the child. After the agent verifies the documents, the IRS will mail the IP PIN to you within a few weeks.

FAQs – Get an IP PIN for a Child

Q1: How long does it take to get an IP PIN for my child?

If you use the online “Get An IP PIN” tool, the process is instantaneous once identity verification is complete. However, if you apply via Form 15227 or an in-person meeting, it typically takes 4 to 6 weeks for the IRS to process the request and mail the PIN to your home.

Q2: What happens if I lose my child’s IP PIN?

If you lose the PIN, you can log back into the IRS online tool to retrieve it. If you cannot access the online account, you must call the IRS at 800-908-4490 to have the PIN reissued, which can take up to 21 days to arrive by mail.

Q3: Can I opt out of the IP PIN program later?

Currently, once you are enrolled in the IP PIN program, you cannot opt out. You will be required to provide a new PIN every year for the foreseeable future. This is a permanent security feature for your child’s SSN.

Q4: Does my child need to be a victim of fraud to apply?

No. As of 2026, the program is open to any taxpayer or dependent nationwide who can verify their identity. You do not need to prove that identity theft has already occurred.

Bottom Line

Obtaining a unique security code is a powerful way to safeguard your family’s financial future. By following the online application steps and maintaining strict digital security, you can ensure that your child’s identity remains private and protected from fraudulent activities for years to come.