While physical credit cards feel “real,” they are increasingly becoming a liability. In 2026, payment fraud has evolved; hidden cameras and invisible skimmers now turn a simple swipe or tap into a security risk. Every time you pull out your plastic card, you are essentially exposing your private data to anyone (or any device) watching. Many users find themselves asking: Is Apple Pay safe enough to replace the wallet they’ve carried for decades?

In this guide, we’ll explore why your iPhone is actually your strongest defense against modern fraud.

What Is Apple Pay? How Does It Work?

Apple Pay is a mobile payment technology that allows you to make purchases using your iPhone, Apple Watch, or iPad. However, describing it simply as a “digital wallet” doesn’t quite do justice to the heavy lifting happening behind the scenes. Unlike a physical wallet that just holds your cards, Apple Pay acts as a sophisticated security intermediary.

To understand how it works, think of a traditional credit card transaction as handing over a photocopy of your ID to every merchant you visit; your name, card number, and security code are all right there for them to see and potentially store.

Apple Pay changes this dynamic through a process called Tokenization. As many users on Reddit have pointed out, using Apple Pay is effectively like “exchanging secret codes” with a merchant rather than sharing actual data.

Here is the technical breakdown in plain English:

- The “Secret Handshake”: When you add a card to your Apple Wallet, Apple doesn’t store your actual card number on the device or its servers. Instead, it assigns a unique Device Account Number.

- The One-Time ID: When you double-click that side button to pay, Apple Pay doesn’t transmit your card info. Instead, it generates a Dynamic Security Code.

- Single-Use Security: This code acts as a “temporary ID” for that specific transaction. Once the payment is processed, that code becomes useless. Even if a hacker were to intercept the data from the merchant’s system, they would find nothing but a string of gibberish that cannot be used again.

This seamless “tap-to-pay” experience, whether you’re using your phone or just a flick of your wrist with an Apple Watch, is only possible because of this real-time encryption. It’s why merchants prefer it: it significantly reduces fraud because they never actually “touch” your sensitive financial data.

Is Apple Pay Safe?

While many still feel a physical card is more “real,” it is actually the weakest link in your payment security. Using Apple Pay eliminates several common risks that physical cards simply can’t avoid.

Immunity to Skimmers

Card skimming is a massive issue at gas stations and ATMs, where criminals install hidden readers over the card slot to steal magnetic stripe data. Since Apple Pay uses NFC (Near Field Communication) for a contactless connection, there is no physical slot to worry about. You are essentially bypassing the “physical traps” that make traditional cards so vulnerable.

Protection Against Visual Theft

Every time you take your card out, its most sensitive details – the 16-digit number, expiration date, and CVV code – are exposed. As many Reddit users have pointed out, tiny cameras hidden near checkout counters can easily record this info. With Apple Pay, your card never leaves your wallet. Your real data remains encrypted within the Secure Enclave, a dedicated chip in your device that never shares your actual card information with anyone.

Built-in Biometric Defense

The biggest risk of a physical card is that anyone who finds it can use it, especially for small “tap” transactions that don’t require a PIN. Apple Pay solves this with a mandatory second layer of defense. Whether it’s FaceID, TouchID, or your passcode, a transaction cannot happen without your biometric authorization. Even if your phone is stolen, your money stays locked behind a barrier that a physical card simply doesn’t have.

Given the risks of physical skimmers and visual theft, the most proactive step you can take for your financial security is to set up Apple Pay today.

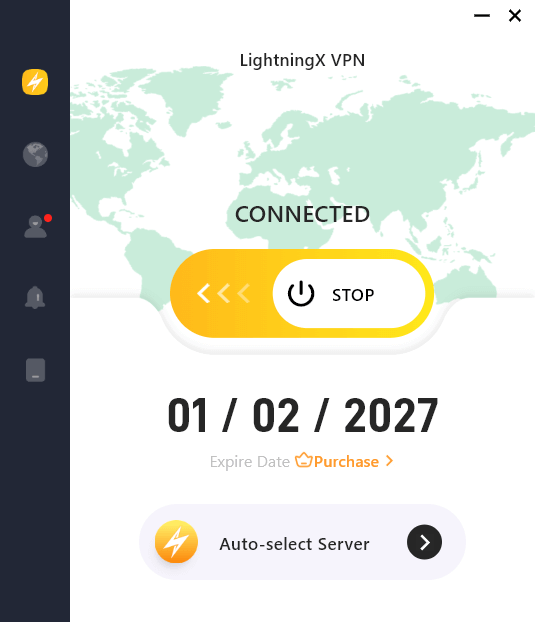

While Apple Pay protects your transaction through tokenization, your overall data can still be vulnerable on public Wi-Fi. Using a VPN like LightningX VPN adds an extra layer of encryption to your entire connection, preventing hackers on the same network from monitoring your online activity while you shop.

How to Avoid Apple Pay Spam?

It is important to distinguish between “system hack” and “social engineering.” While Apple Pay’s encryption is nearly impossible to breach, attackers often target the weakest link: the user. Staying safe is less about fixing software and more about recognizing manipulation.

Recognize Phishing and Fake Alerts

Most Apple Pay “scams” don’t happen at the checkout counter; they happen in your inbox. You may receive iMessages or texts claiming your “account is suspended” or there is a “suspicious refund” that requires your action. These messages often include a link to a fake login page designed to steal your Apple ID credentials.

Remember: Apple will never ask for your password or a 2FA verification code via text.

Related: Apple Security Alert Scam: How to Spot and Avoid It?

The “Card Out of Sight” Risk

Spam and fraud often start when you are forced to revert to old habits. In many U.S. restaurants, it is still common for servers to take your physical card to a back terminal. This is a high-risk moment where card details can be photographed or recorded. Whenever Apple Pay isn’t an option, try to pay at the front counter or use a portable terminal. Never let your physical card leave your sight.

Secure Your Apple Cash Settings

By default, Apple Cash may allow people not in your contacts to send you payment requests, which can lead to “unsolicited request” spam. To tighten your security:

- Go to Settings > Wallet & Apple Pay.

- Tap on your Apple Cash card.

- Under Allow Requests From, switch the setting to Contacts Only.

By treating Apple Pay as a tool that requires your active oversight, you can enjoy its high-level encryption without falling for the human-centric traps that scammers rely on.

To combat social engineering, Apple has introduced smarter message filtering. Checking out the latest iOS 26 features will show you how the new system-level AI helps identify and block Apple Pay-related phishing attempts automatically.

FAQs – Is Apple Pay Safe

Q1: Is Apple Pay safe if I lose my phone?

Yes, and it’s far more secure than losing a physical wallet. Even if someone has your device, they cannot spend your money without your FaceID, TouchID, or passcode.

If your phone goes missing, you can:

- Activate Lost Mode: Use the “Find My” app on another device to instantly suspend Apple Pay.

- Remote Wipe: Log into iCloud.com to remove your cards from the device entirely.

Because your actual card numbers aren’t stored on the phone, a thief has no way to access your bank details, even if they manage to break into the hardware.

Q2: Does Apple Pay work without an internet connection?

Yes. You can pay in physical stores without Wi-Fi or cellular data. Apple Pay uses NFC (Near Field Communication) technology to talk to the payment terminal directly. Since your “Device Account Number” is stored on the phone’s hardware chip (Secure Enclave), the transaction doesn’t need your phone to be online.

Note: You will need internet access later to see your updated transaction history in the Wallet app.

Q3: Can a merchant refund a purchase made via Apple Pay?

Yes. Refunds work just like a regular card refund. You simply hold your iPhone or Apple Watch near the reader as you did when paying. The merchant will use your Device Account Number (the “virtual” card number) to find the transaction and process the return. You don’t need to provide your physical card or its real number for the refund to go through.