PayPal is a popular online payment system that allows people to send and receive money electronically. Whether you’re buying something online, sending money to a friend, or receiving payments for a service you’ve offered, PayPal makes transactions easy and secure. But what is PayPal, and how does it work? In this article, we will break down the basics of PayPal, its uses, and how it can benefit you.

What Is PayPal?

PayPal is a digital payment platform that allows users to make transactions without sharing their financial information with the other party. Established in 1998, PayPal has grown into one of the most widely used payment systems in the world. People use it for a variety of reasons: to shop online, pay bills, transfer money to friends or family, or even receive payments for products or services they sell.

With PayPal, all you need is an account, and you can link it to your credit card, debit card, or bank account. This system provides an additional layer of security since your actual card or bank details are not shared during the transaction.

How Does PayPal Work?

To use PayPal, you first need to create an account. The setup process is simple:

- Sign up: Visit the PayPal website and click the “Sign Up” button. You’ll be asked to provide your email address and create a password.

- Link your account: After setting up your PayPal account, you can link your bank account, credit card, or debit card to it. This makes it easy to transfer money in and out of PayPal.

- Start using PayPal: Once your PayPal account is ready, you can start using it to pay for goods and services online, send money to friends, or receive payments.

The beauty of PayPal is its simplicity. You can send or receive money with just an email address. No need to share bank account numbers or credit card details with others. When making a payment, you simply log in to your PayPal account, choose which payment method you want to use (linked bank account or card) and complete the transaction.

Why Do People Use PayPal?

PayPal has several features that make it attractive for both buyers and sellers. Below are some of the key reasons why people choose PayPal:

- Ease of use: PayPal is extremely user-friendly. Once your account is set up, making payments or receiving money takes just a few clicks.

- Security: PayPal acts as a middleman between the buyer and the seller. This means that your financial information (like your bank account or credit card number) is not shared with the person or company you’re dealing with.

- Global reach: PayPal is available in over 200 countries, and you can send money in various currencies. This makes it ideal for international transactions.

- Buyer protection: If you make a purchase and the item doesn’t arrive or is significantly different from what was described, PayPal offers buyer protection. You may be eligible for a refund.

- Seller protection: Similarly, PayPal offers seller protection for those who sell goods and services. If someone files a dispute or unauthorized charge, PayPal will help resolve it, potentially reimbursing the seller.

What Is PayPal: PayPal for Online Shopping

One of the main reasons people use PayPal is for online shopping. PayPal is accepted on millions of websites, including major retailers like eBay, Amazon, and Walmart. This allows you to shop online without worrying about entering your credit card information on multiple sites.

When you choose PayPal as a payment option during checkout, you simply log in to your PayPal account, select your preferred payment method, and confirm the purchase. It’s that easy!

PayPal also offers an added layer of security by providing dispute resolution if something goes wrong with your purchase, such as not receiving the item or receiving something different from what was advertised.

Related: How Does eBay Work? Everything You Need to Know

What Is PayPal: Sending Money to Friends and Family

Another great feature of PayPal is that it allows you to send money to friends and family quickly. If you owe someone money for dinner or want to send a gift, you can use PayPal to transfer funds with ease. Just enter the recipient’s email address, choose the amount, and send the money.

There are no fees when sending money to friends and family if you use your PayPal balance or a linked bank account. However, there may be a small fee if you choose to send money using a credit card.

What Is PayPal: Receiving Payments with PayPal

If you sell goods or services, you can use PayPal to receive payments. This is especially useful for freelancers or small businesses. PayPal makes it easy to invoice clients and receive payments directly into your PayPal account. Once the payment is in your account, you can transfer it to your bank, use it to shop online, or even send the money to others.

Many people prefer to pay with PayPal because they trust it. As a seller, offering PayPal as a payment option can increase your credibility and attract more customers.

Fees and Costs

While sending money to friends and family is often free, there are some fees associated with other types of transactions. For example:

- When receiving payments for goods or services, PayPal charges a fee, typically around 2.9% plus a small fixed fee per transaction.

- International payments may incur additional fees.

- Currency conversion fees may apply if you send or receive money in a different currency.

It’s important to be aware of these fees before using PayPal, especially if you’re a business owner.

Keep Your PayPal Account Secure

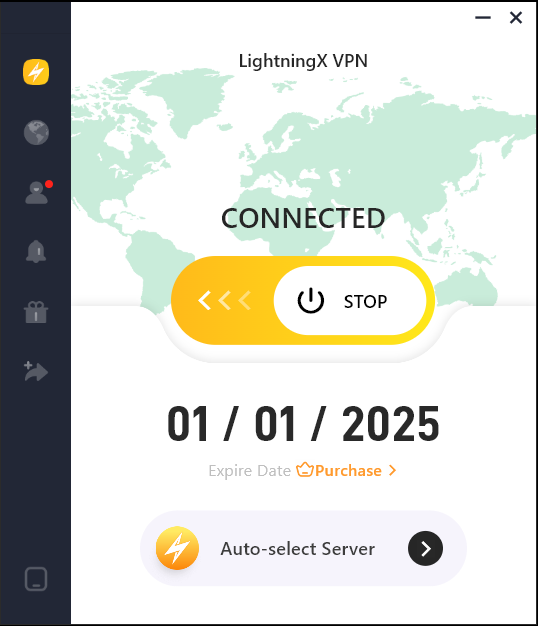

While PayPal is generally secure, it’s always a good idea to take extra steps to protect your account. One way to do this is by using strong passwords and enabling two-factor authentication. Another way is by using a VPN when accessing your PayPal account on public Wi-Fi.

Using a VPN, such as LightningX VPN, encrypts your internet connection, making it harder for hackers to intercept your data. This is especially important if you’re using PayPal in coffee shops, airports, or other places where public Wi-Fi is available. A VPN can give you peace of mind by adding an extra layer of protection while you manage your financial transactions online.

With 2000+ servers in over 50 countries, you can easily bypass many geo-restrictions using LightningX VPN. Many services restrict access based on geographic location. By connecting to different nodes, you can bypass these restrictions and access content that may not be available in your region.

If you are new to it, you can have a 7-day free trial, and not worrying being dissatisfied with it, since it will give you all your money back in 30 days without requiring any reason.

PayPal Alternatives

While PayPal is one of the most popular online payment systems, there are alternatives you might consider:

- Venmo: Owned by PayPal, Venmo is a peer-to-peer payment service that’s popular for splitting bills and paying friends. It’s less formal than PayPal and has a social element where you can see friends’ transactions.

- Apple Pay: A mobile payment service for Apple users. It allows you to make payments online, in apps, and in stores using your Apple device.

- Google Pay: Similar to Apple Pay, Google Pay allows users to make payments online or in stores using their Google account.

Each platform has its pros and cons, but PayPal’s wide acceptance and strong security features make it a top choice for many.

Conclusion

In summary, PayPal is a powerful and secure tool for managing your money online. Whether you’re shopping, sending money to a friend, or running a business, PayPal offers a convenient solution. With features like buyer and seller protection, it’s easy to see why millions of people around the world rely on PayPal for their everyday transactions. PayPal makes life easier, and with a few security measures in place, you can enjoy the convenience with peace of mind.